Grant Park Dynamic Allocation Fund

GPKAX | GPKIX

A mutual fund designed for advisors seeking to strengthen equity growth with the potential for enhanced risk-reward. The Fund seeks to provide positive absolute returns.

www.grantparkfunds.com

800.217.7955

The Fund is designed as a strategic alternative

to potentially reduce a portfolio’s downside equity risk.

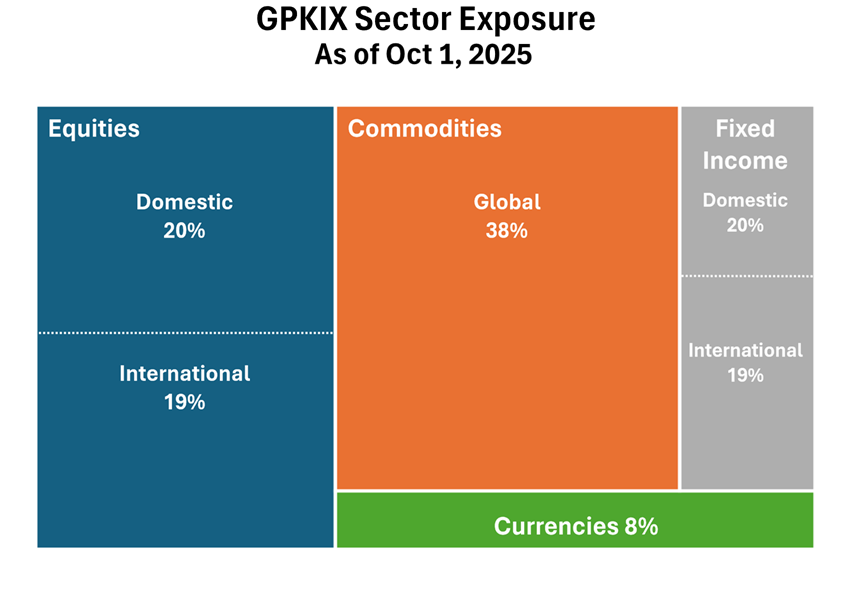

The investment program seeks to expand a portfolio’s equity exposure while concurrently investing across a variety of global markets to produce a series of risk premia returns.

The aim is to create a performance profile that enhances investment portfolios and:

-

Potentially increases returns

-

Seeks to reduce overall downside risk and volatility

-

Strives to diversify a portfolio's investment universe

Program Overview

The Fund seeks:

-

Positive absolute returns to reduce portfolio risk when combined with equity investments.

-

Multiple, active managed risk-premia strategies to create diversified return streams.

-

To deliver dynamic beta as multiple managers react to shifting market conditions.

Stacked Risk Premia

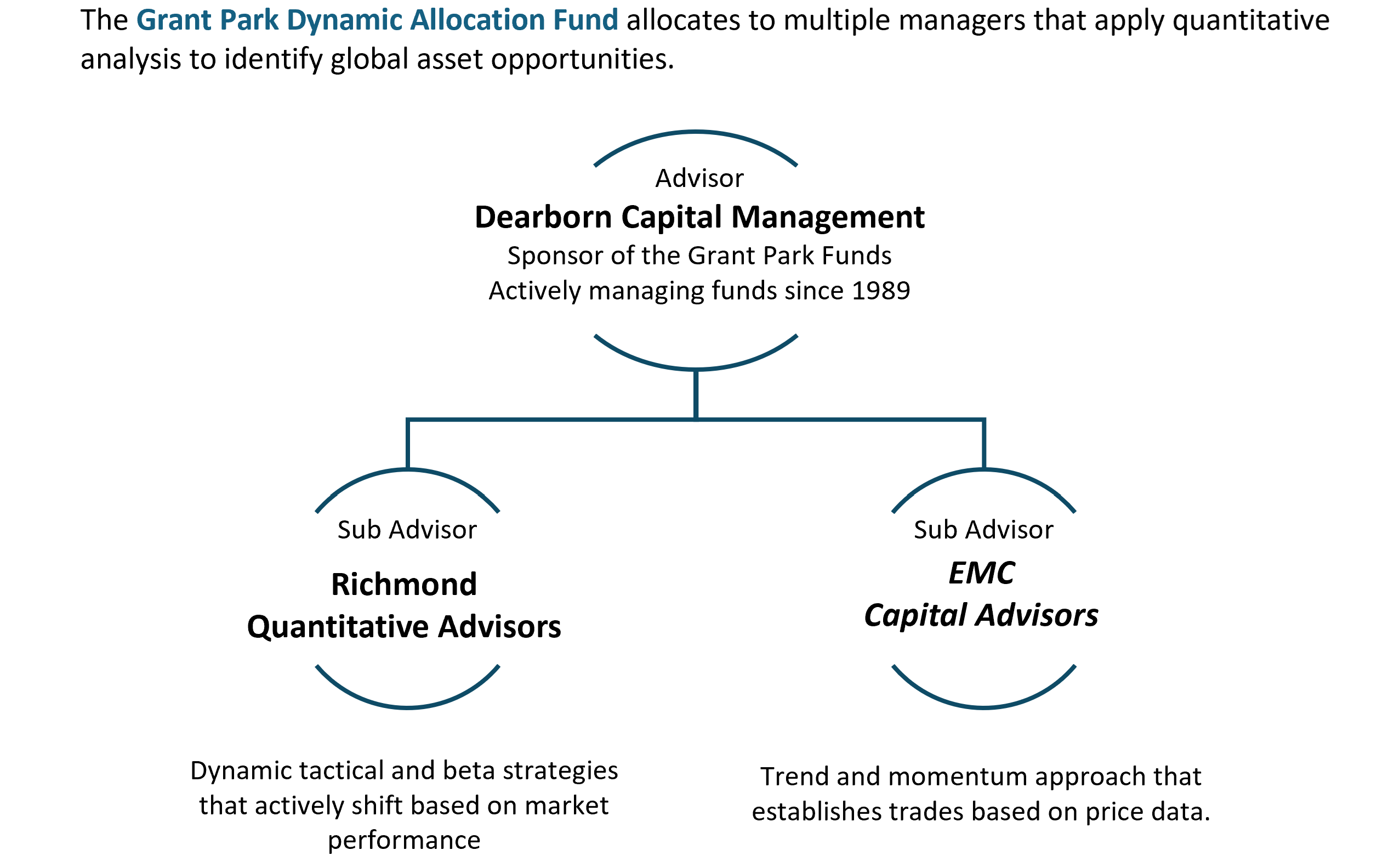

The Grant Park Dynamic Allocation Fund utilizes a stacked risk premia approach that combines multiple sources of risks and returns to seek greater returns and enhanced diversification.

|

Tactical Alpha |

Provides the potential to profit in rising and falling markets |

|

|

Dynamic Beta |

Potential for rapidly increasing or decreasing risk in rising or falling markets |

|

|

Active Allocations |

Actively manages allocations to pursue an enhanced Sharpe ratio |

|

|

Portfolio |

Attempts to: Capture growth similar to equities, Reduce downside risk and Improve portfolio diversification |

Source: Zephyr

Source: Zephyr

Source: Zephyr

Source: Zephyr

Source: Dearborn Capital Management, LLC

Source: Dearborn Capital Management, LLC

Source: Dearborn Capital Management, LLC

Source: Dearborn Capital Management, LLC

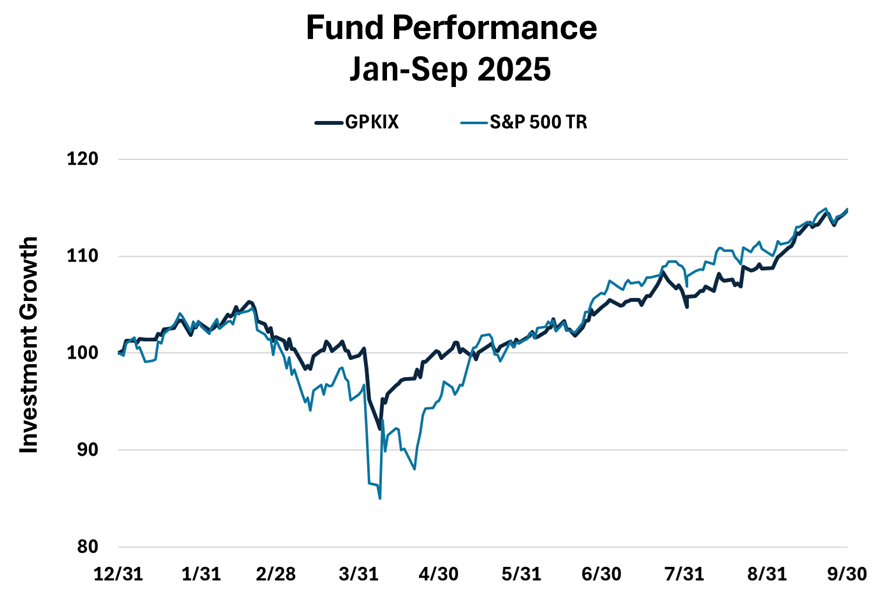

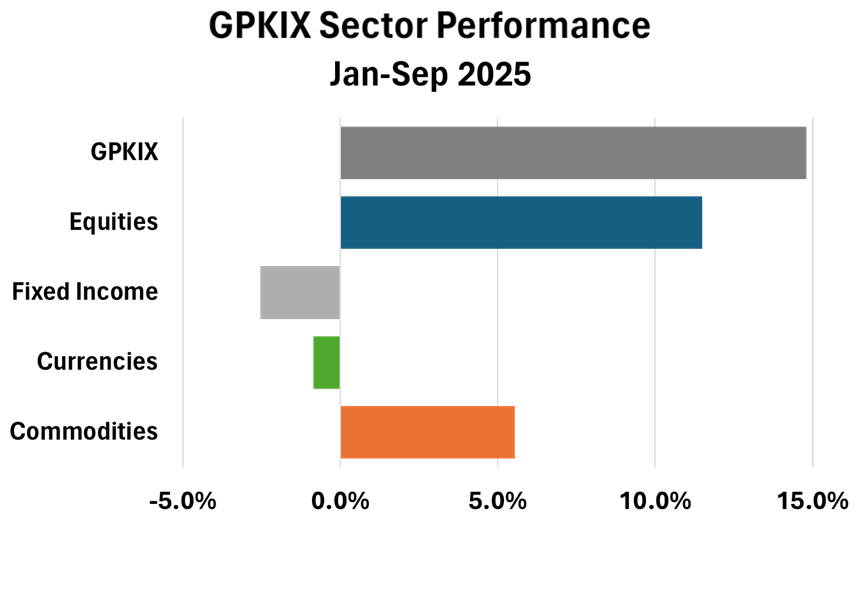

Performance

Performance Overview

GPKIX Monthly Performance

|

|

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

YTD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

GPKIX |

3.00% |

-1.26% |

-1.87% |

0.30% |

1.00% |

3.56% |

0.96% |

2.84% |

5.61% |

14.80% |

|||

|

S&P 500 TR |

2.78% |

-1.30% |

-5.63% |

-0.68% |

6.29% |

5.09% |

2.24% |

2.03% |

3.65% |

14.83% |

Performance as of September 30, 2025

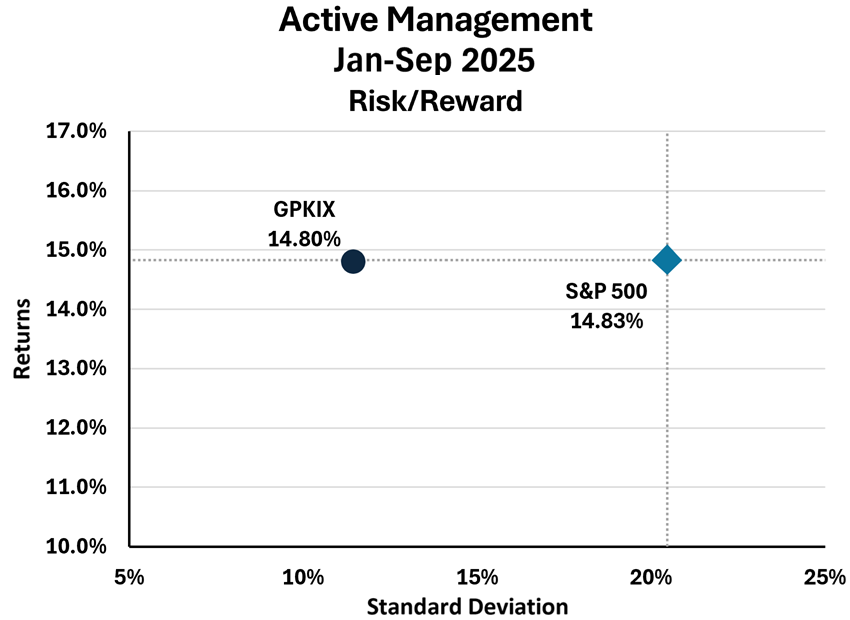

|

|

Q3 |

2025 YTD |

Since Inception |

Standard Deviation |

Sharpe Ratio |

Correlation |

Beta |

Down Capture |

|---|---|---|---|---|---|---|---|---|

|

Without Max Sales Charge |

||||||||

|

Class I (GPKIX) |

9.65% |

14.80% |

14.80% |

11.46% |

1.42 |

0.72 |

0.40 |

52.80% |

|

S&P 500 TR |

8.12% |

14.83% |

14.83% |

20.46% |

0.80 |

1.00 |

1.00 |

100% |

|

With Max Sales Charge |

||||||||

|

Class A (GPKAX) |

3.25% |

7.92% |

7.92% |

NA |

NA |

NA |

NA |

NA |

|

Fund inception is 12/27/2024. The maximum sales charge (load) for Class A is 5.75%. The performance data quoted here represents past performance. For performance data current to the most recent month end, please call toll-free 855.501.4758. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The Fund’s total annual operating expenses are 2.03%, and 1.78% for Class A and I, respectively. The Fund’s total annual operating expenses are 1.87%, and 1.62% after fee waiver for Class A and I, respectively. The advisor has contractually agreed to waive management fees and to make payments to limit fund expenses until at least January 31, 2026. Please review the Fund’s prospectus for more information regarding the Fund’s fees and expenses, including other share classes. |

||||||||

Current Fund performance available at www.morningstar.com

Multi-Advisor Integration

Next Steps