What are Liquid Alternatives?

These represent a category of funds that combine daily liquidity (in a mutual fund format) with non-traditional strategies that are typically unavailable to most individual investors.

Grant Park Funds has over 30 years experience creating and operating alternative investment funds which access multiple quantitative and discretionary investment strategies. Our experience reinforces the belief that long-term value is driven by three core mandates seeking to:

- Preserve capital and deliver positive returns over extended market cycles.

- Maintain a low correlation with traditional stock and bond investments.

- Enhance the risk/return profile of an existing portfolio.

Organizing the investment landscape can help to identify which alternative investments are candidates for consideration. Each industry-leading content platform organizes assets into various groups and categories.

Alternative Investment Categories

|

Potential Portfolio Benefits |

|||

|

|

Strategic Diversification |

Low Correlation |

Risk/ Reward |

|

Bear Market |

♦ |

|

|

|

Currency |

♦ |

|

|

|

Global Macro Trading |

♦ | ♦ | ♦ |

|

Long/ Short Equity |

♦ |

|

|

|

Managed Futures |

♦ | ♦ | ♦ |

|

Market Neutral |

♦ |

|

|

|

Multialternative |

♦ |

|

♦ |

Potential Benefits of Accessing Liquid Alternatives

1. Strategic Diversification

Compared to traditional investments, the following factors form the core of liquid alternative investments and create the basis for enhanced portfolio diversification:

Non-traditional strategies:

Diverse strategies, such as quantitative analysis, are dissimilar to strategies found in traditional investments.

Broad investment universe:

Access to global financial and commodity markets not typically included in traditional investments.

Ability to invest long and short:

Alternative investments may invest long and short, seeking profitable opportunities as prices rise or fall.

We believe the diversification benefits offered by liquid alternatives can help investors navigate the unforeseen drawdowns seen in traditional markets and smooth out the return stream.

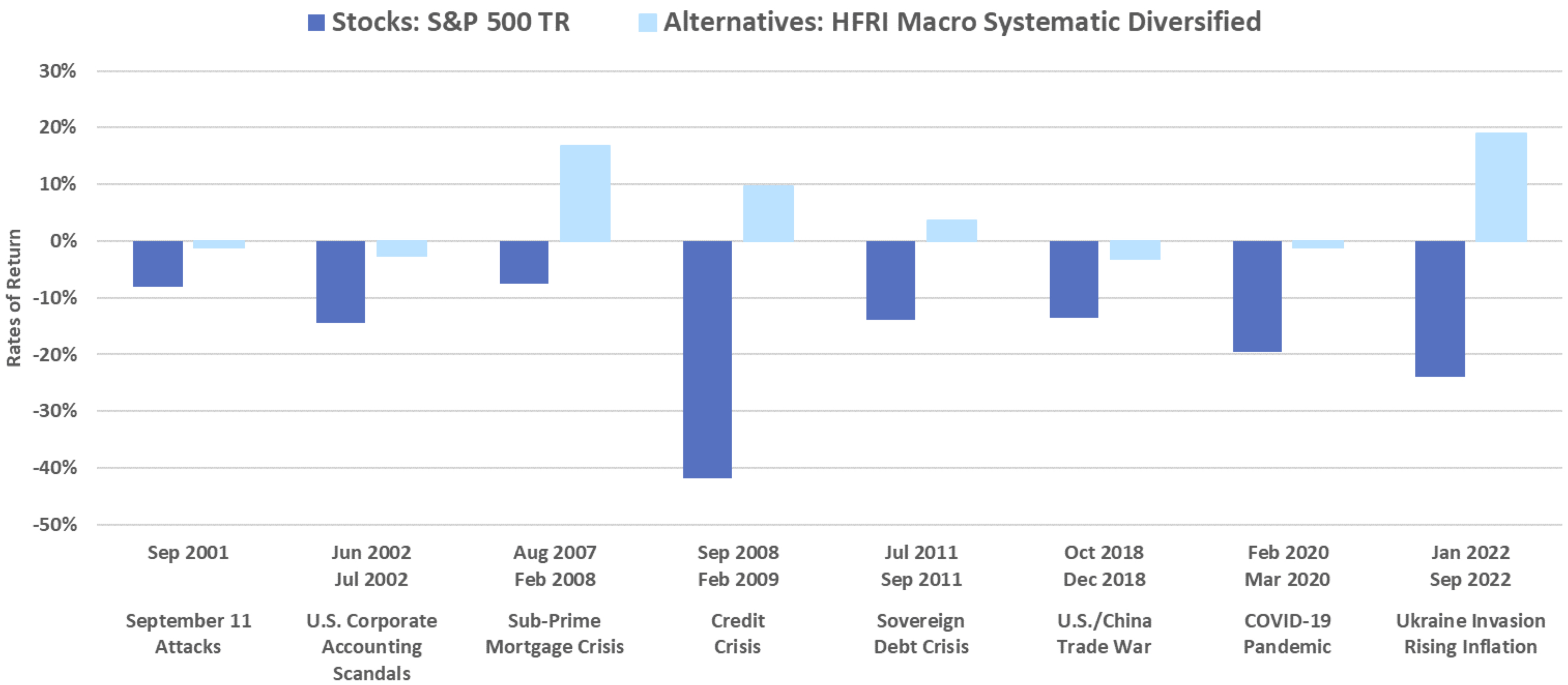

Alternative Strategies v. S&P 500

During Crisis Periods

The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

2. Low Correlation

Enhancing a portfolio's risk/return profile is driven by the ability to include investments that display a low correlation to stocks and bonds. Typically, value-enhancing, diversifying investments produce independent returns through the strategies they execute, the universe in which they invest and the disciplined risk management that is applied to an actively managed portfolio. The combination of these factors can create an asset that contributes unique, persistent value to a portfolio's profile.

The table below provides correlations in Morningstar’s alternative category groups. Actual funds may have lower correlations and offer greater diversification.

Liquid Alternative Categories

Jan 1, 2020 - Dec 31, 2024

| Category Names | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|

| 1 Morningstar Macro Trading | 1.00 | ||||||||

| 2 Morningstar Equity Market Neutral | 0.21 | 1.00 | |||||||

| 3 Morningstar Event Driven | 0.69 | 0.06 | 1.00 | ||||||

| 4 Morningstar Long-Short Equity | 0.83 | 0.22 | 0.79 | 1.00 | |||||

| 5 Morningstar Multistrategy | 0.89 | 0.29 | 0.87 | 0.91 | 1.00 | ||||

| 6 Morningstar Options Trading | 0.71 | 0.07 | 0.73 | 0.94 | 0.81 | 1.00 | |||

| 7 Morningstar Relative Value Arbitrage | 0.71 | -0.04 | 0.89 | 0.75 | 0.83 | 0.72 | 1.00 | ||

| 8 Morningstar Managed Futures | 0.39 | 0.10 | -0.06 | -0.05 | 0.11 | -0.23 | -0.07 | 1.00 | |

| 9 Bloomberg Barclays Global Aggregate | 0.35 | -0.08 | 0.49 | 0.60 | 0.46 | 0.69 | 0.53 | -0.53 | 1.00 |

| 10 S&P 500 TR | 0.76 | 0.10 | 0.75 | 0.96 | 0.85 | 0.98 | 0.74 | -0.15 | 0.63 |

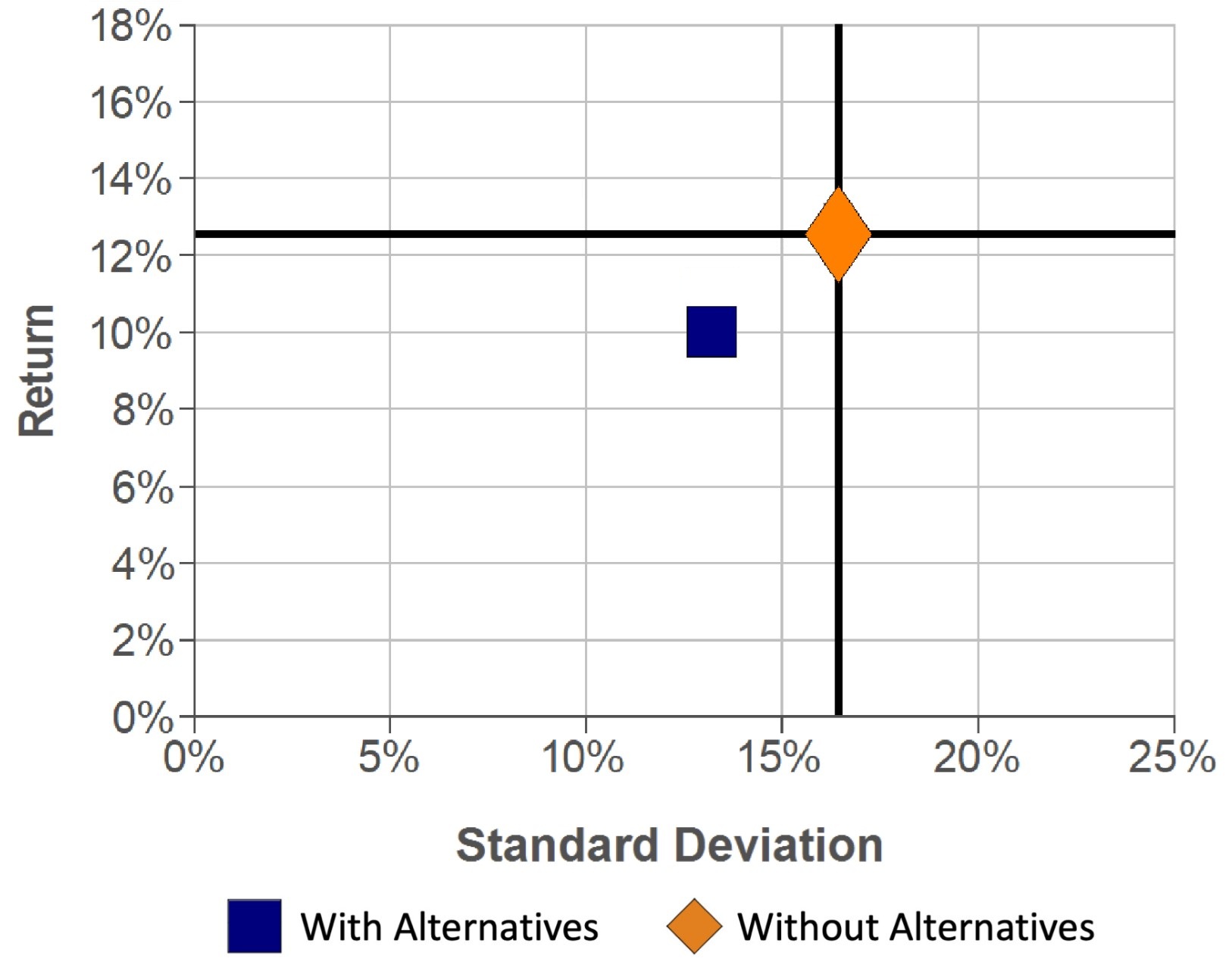

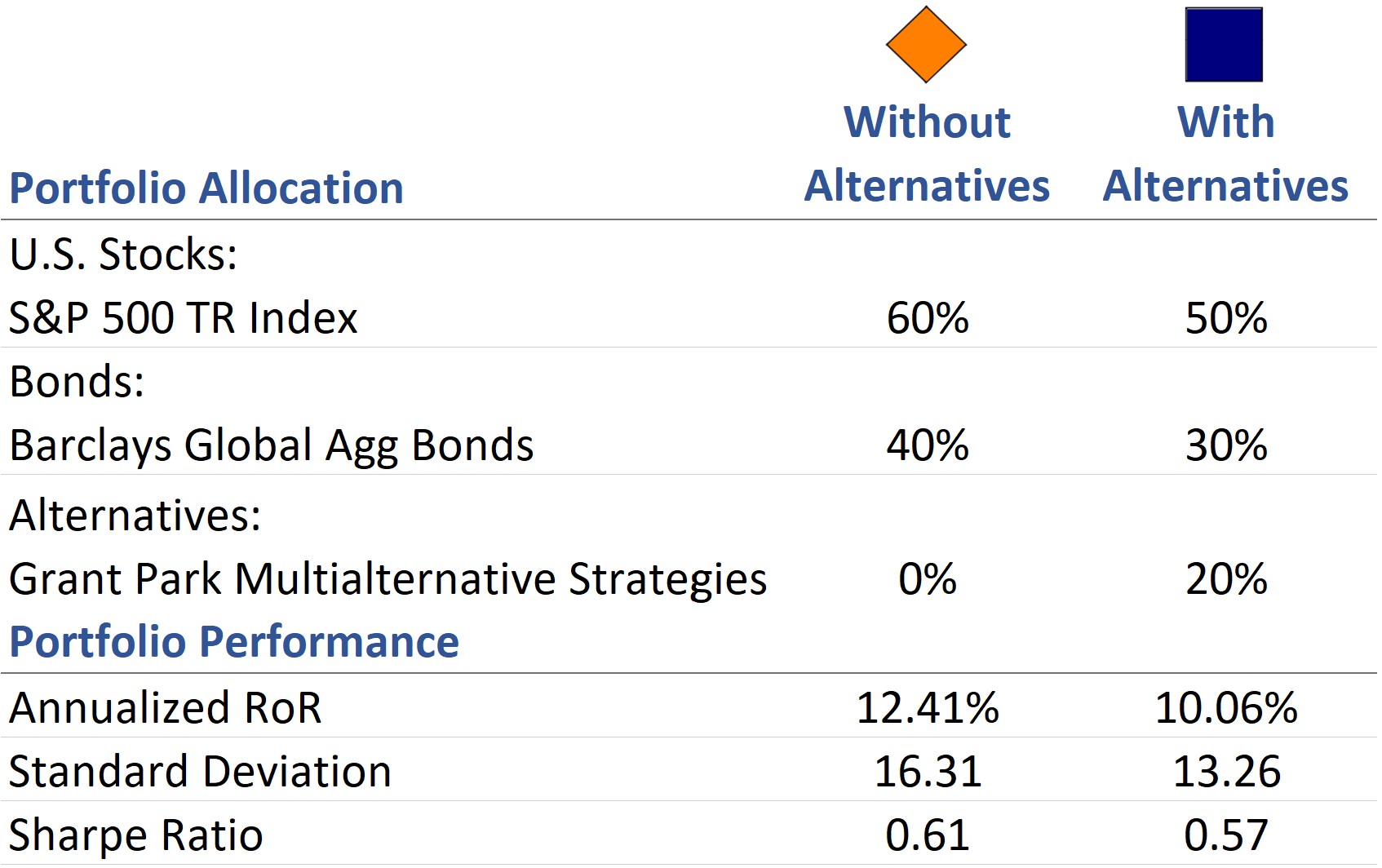

3. Enhanced Risk Reward

Adding alternatives that offer diversification and produce low correlated returns can enhance a portfolio’s long-term risk adjusted returns.

Risk Reward

Jan 1, 2020 - Dec 31, 2024

Past performance is no guarantee of future results.

Building An Alternative Sleeve

Identify the risks to the portfolio and define the objective of the alternative sleeve. For example, are you:

- Concerned about equity corrections?

- Worried about rising volatility and erratic market behavior?

- Concerned about rising or negative rates?

- Lacking diversification in your portfolio?

Liquid Alternatives can help minimize the risks to a portfolio. When considering a strategy, select proven managers and funds that seek to offer the following:

- Provide diversification and reduce portfolio concerns.

- Have a low correlation to the traditional markets and other alternatives.

- Improve the risk-reward profile of the portfolio.

- There is no guarantee that any investment will achieve its objectives, generate positive returns, or avoid losses. No level of diversification or non-correlation can ensure profits or guarantee against losses.